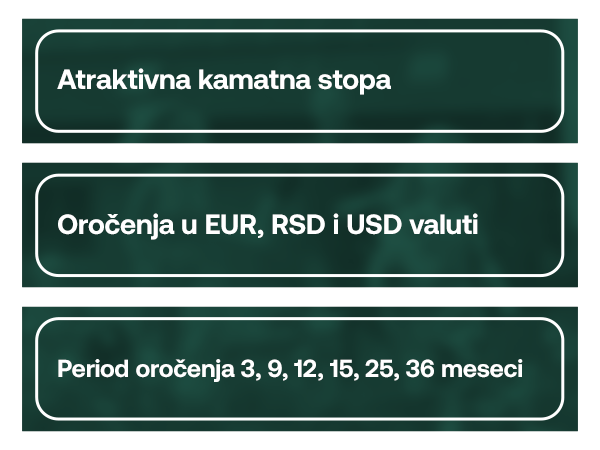

Fixed-Term Savings

Available on both RSD and foreign currency deposits suited to your needs

Fixed-Term Savings Calculator

Example

Example of Fixed-Term Savings over 12 months in the RSD, NIR 4.00%

Type of deposit | Fixed-Term Deposit in RSD |

Total deposit amount | 3.000.000,00 |

Deposit currency | RSD |

Deposit term | 12 months |

Nominal Interest Rate per annum (NIR) | 4,00% (fixed, per annum) |

Effective Interest Rate per annum (EIR)* | 4,00% |

Indexation criterion | None |

Interest calculation method | Proportional method |

Total gross interest amount at maturity | 119.917,35 RSD |

Depositor’s tax obligation | None (0,00 RSD) |

Fees and charges | No fees are charged to the depositor |

Total amount payable to the depositor at maturity | 3.119.917,35 RSD |

Example of Fixed-Term Savings over 12 months in the EUR, NIR 3.00%

Type of deposit | Fixed-Term deposit in EUR |

Total deposit amount | 30.000,00 |

Deposit currency | EUR |

Deposit term | 12 months |

Nominal Interest Rate per annum (NIR) | 3,00% (fixed, per annum) |

Effective Interest Rate per annum (EIR)* | 2,55% |

Indexation criterion | None |

Interest calculation method | Proportional method |

Total gross interest amount at maturity | 899,38 |

Depositor’s tax obligation | Income tax: 15% (131,91 EUR) |

Fees and charges | No fees are charged to the depositor |

Total amount payable to the depositor at maturity | 30.764,47 EUR (3.600.596,66 RSD) |

Example of Fixed-Term Savings over 12 months in American dollars (USD), NIR 1.00%

Type of deposit | Fixed-term deposit in the USD |

Total deposit amount | 30.000,00 |

Deposit currency | USD |

Deposit term | 12 months |

Nominal Interest Rate per annum (NIR) | 1,00% (fixed, per annum) |

Effective Interest Rate per annum (EIR)* | 0,85% |

Indexation criterion | None |

Interest calculation method | Proportional method |

Total gross interest amount at maturity | 299,79 |

Depositor’s tax obligation | Income tax: 15% (44,97 USD) |

Fees and charges | No fees are charged to the depositor |

Total amount payable to the depositor at maturity | 30.254,82 USD (3.177.733,33 RSD) |

Online Fixed-Term Savings

Frequently Asked Questions

No, there are no fees for managing these accounts.

You can open savings accounts in RSD, EUR, USD, and CHF currencies.

Yes, you can. Deposits can be made in cash at one of our bank counters, cash deposits at multifunctional ATMs available in our 24/7 Zones, transfers from another account within AIK Banka via electronic or mobile banking, or via standing orders from your current account.

Yes, of course! We offer a wide range of savings products for individuals with non-resident status.

Yes, the insured amount is up to EUR 50,000 per depositor in the bank. The insurance covers cash deposits, savings deposits, current accounts, and other monetary accounts, as well as any other funds temporarily deposited during regular banking operations, which the bank returns to the client in accordance with its legal or contractual obligations.

For sight savings (so called: a vista), interest is credited at the end of the calendar year. For fixed-term deposits, interest is calculated and credited or paid depending on the fixed-term deposit model you have chosen: At the end of the deposit term Monthly

Funds in a fixed-term deposit are available at maturity. However, if you require them prior to the expiry of the agreed term, you can request early withdrawal. It's important to note that in the case of early withdrawal from a fixed-term deposit with monthly interest payments or advance interest payments, the amount paid upon early withdrawal will be reduced by any previously accrued and paid gross interest and increased by the net interest calculated at the rate applied to sight deposits in EUR.

Sight Savings means that all the deposited money is available to you at any time. There are no maturity dates for interest, and you are not limited in accessing the funds in the account.

If your savings are in the domestic currency, no tax is paid. If you have deposited foreign currency, a 15% income tax is applied to the interest earned.