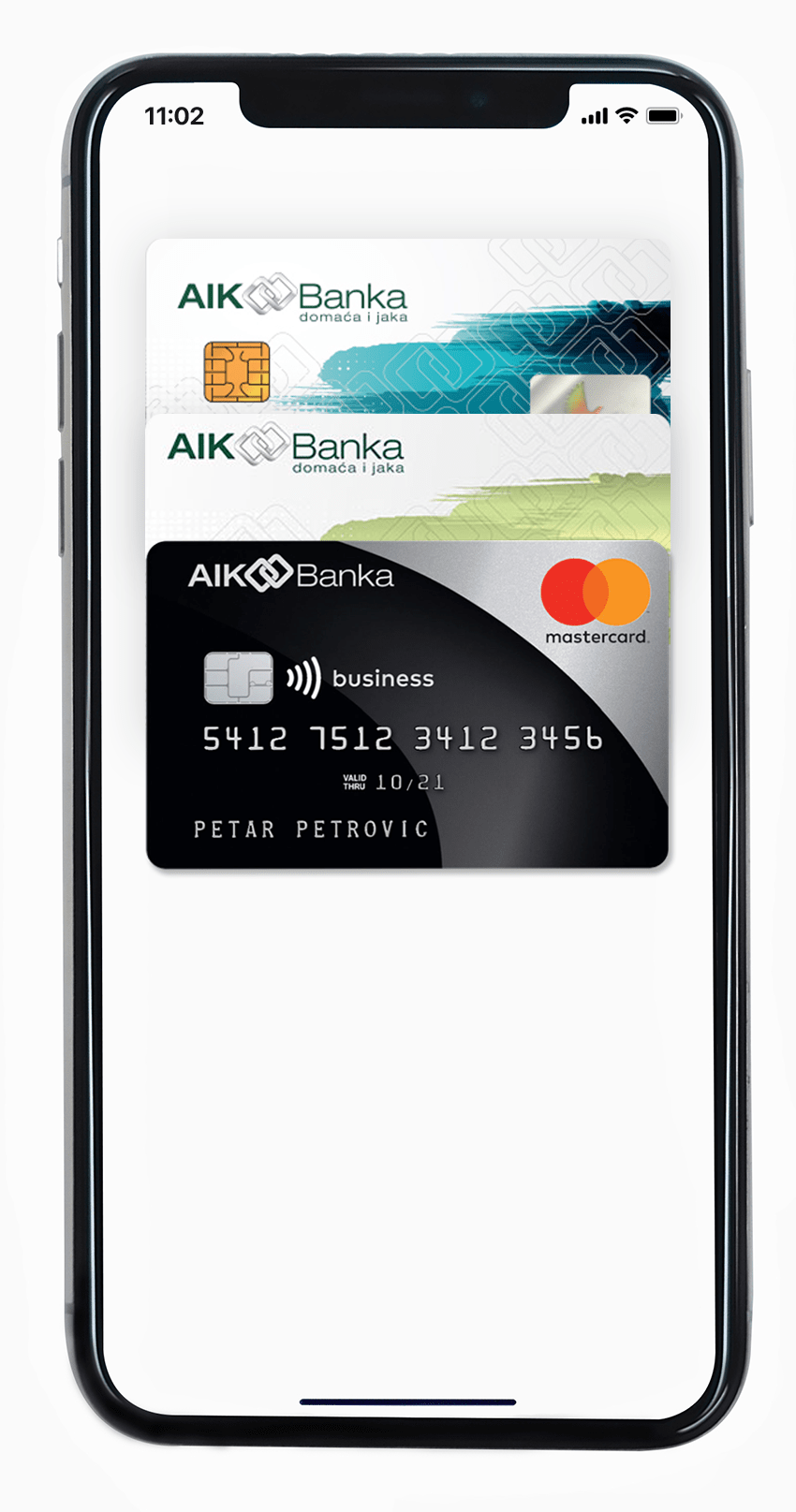

Business Mastercard card

access your funds 365 days a year, 24 hours a day, locally and abroad

A payment card for legal entities and entrepreneurs linked to your RSD account allows you to

Make payments and withdraw funds in the country and abroad at most POS and ATM terminals

Keep accurate records and monitor employee expenses. You can secure additional cards for employees you wish to authorise, and can set monthly spending limits on each additional card

Perform internet transactions with maximum security. With the 3D Secure service, security when using cards online has been enhanced

Business trips made easy, with continuously available funds on your company’s payment account (with clearly set spending limits)

With contactless payment technology, without the need to enter a PIN, for amounts up to RSD 4,000 at all identified domestic Mastercard points of sale

3D Secure

When paying at online points of sale displaying the Mastercard SecureCode, the client has the option to confirm each online transaction using a one-time password, with this improved protection method. The password for online transactions is sent by SMS to your mobile phone number already registered with the Card Alert-SMS Service (executed transaction notification). Update your mobile phone number to which you will receive an SMS message containing your one-time password and complete your internet transaction.

SMS Service

The SMS Service is for receiving information concerning performed transactions and increases security when using payment cards. You will receive an SMS message sent to your mobile phone notifying you of every transaction performed with your payment card

Use it at points of sale and ATMs displaying the Mastercard sign, worldwide. Safer than carrying cash with you. Use it to pay for goods and services (entertainment expenses, travel expenses, etc.), to withdraw funds in the country and abroad and to make payments online (reserve hotel rooms, purchase airline tickets, etc.)

Fixed interest rate

The beneficiary chooses their own repayment model - charge or revolving

Charge option

The user has until the 15th day of the following month to settle their entire expenditure for the current month. If the user repays the entire amount, interest is not charged

Revolving mode

If the user does not pay the entire spent amount, they then switch to the revolving repayment rate of 5%, 10%, 25% and 100%, with an RSD 10,000 minimum*s